1 - 3 Month Outlook

Over the course of October, EUR/CHF drifted lower, though the sharper sell-off in EUR against other currencies still left CHF as one of the relative underperformers in FX. USD/CHF, GBP/CHF and AUD/CHF are back to showing positive correlations to the change in their 2y rate differentials. The Swiss side of that equation is not changing much (2yr Swiss swaps have barely budged since late August), so CHF-pairs driven by the other side of the trade (USD, GBP, AUD) as well as general EUR direction.

The SNB meets again on December 10, a week after the ECB. If the ECB goes ahead with a depo rate cut, it seems likely the SNB will follow suit. The SNB's Zurbruegg says rates remain appropriate for now but that the SNB will analyze all developments and "of course, that'll include an assessment of the ECB's monetary policy measures and their possible effects on Switzerland." The comments on rates echoed those made by SNB Chair Jordan last month (the deposit rate is appropriate for now but "it's possible that it can go lower"). Market consensus is now looking for the interest rate floor at -1.25%. That should put a floor in EUR/CHF (and by extension a higher floor in USD/CHF). The pace of appreciation in EUR/CHF remains painfully slow but that is not expected to change.

"We have positioned for higher EUR/CHF in options with a risk reversal but the tenor (1y at entry, expiring July 2016) shows how long we expect this process to take", says RBC Capital Markets.

6 - 12 Month Outlook

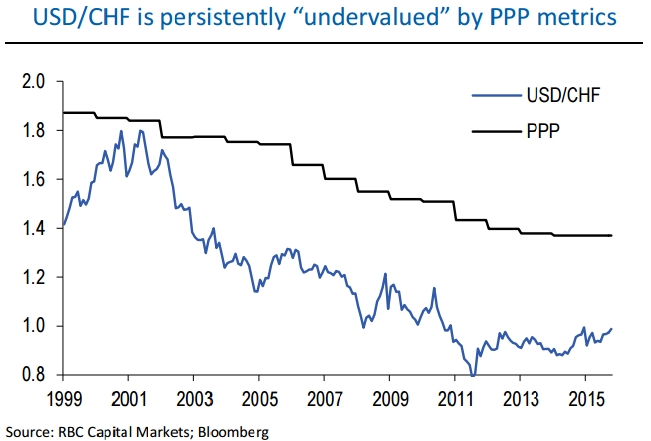

Valuation is often suggested as a reason to be short CHF but the truth is CHF trades persistently above what "fair value" (at least in a PPP sense) would suggest. The driving factor behind the long-term weaker CHF view is Switzerland's inflation outlook which will allow the SNB to keep its nominal rates lowest in the world. While its real rates are amongst the highest in G10. Despite inflation expectations moderating in other countries, Switzerland is still expected to be the only G10 country with inflation hugging zero in 2016.

"We have left our EUR/CHF forecasts unchanged this month and our lower forecasts for EUR/USD mean USD/CHF is revised higher", added RBC Capital Markets.

Swiss Franc Outlook

Thursday, November 5, 2015 11:20 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022