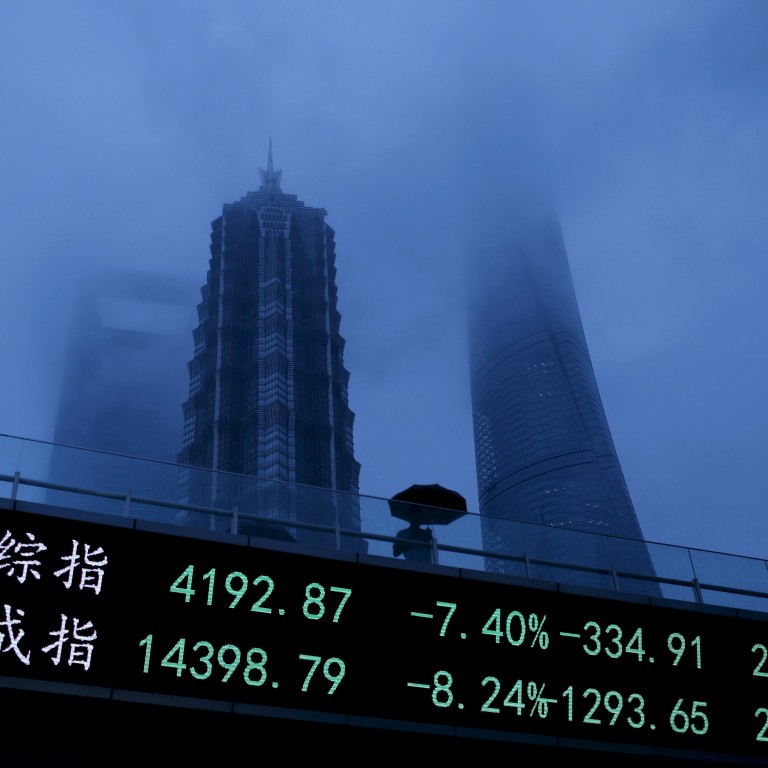

Live | China Markets Live - PBoC devalues yuan; Shanghai and Hong Kong ends shade easier as Shenzhen up at close

Yuan mid-price weakened by almost 2 per cent in biggest devaluation since 1994; Hong Kong market down late

Welcome to the SCMP's live markets blog. The intense volatility of recent weeks has every chance of remaining the core underlying theme of activity. Investors are increasingly focused the broader question of how this episode might affect the wider economy as many suspect the equity bubble has yet to fully deflate. We'll bring you the key levels, trading statements, price action and other developments as they happen.

4:21pm: The Hang Seng Index (orange) and H-shares index (purple) from opening to closing today – click to enlarge.

4:15pm: The Hang Seng index fell in late trading erasing all its gains for the day. The index closed down 0.09 per cent at 24,498.21. The H-share index also fell in the afternoon to 11,264.64, down 0.24 per cent.

3:35pm: China market indices were choppy today: the Shanghai Composite (orange), Shenzhen Composite (green), CSI300 (purple) and ChiNext (blue) against today’s opening. Click to enlarge.

3:33pm: The Hang Seng is trading down 0.09 per cent at 24,498.09. The H-share index is 0.28 per cent weaker at 11,259.5.

3:31pm: Mainland indices seesawed throughout the day in reaction to the central bank decision to devalue the yuan by nearly 2 per cent.

The Shanghai Composite index in the end closed almost flat, down 0.01 per cent, at 3,927.91. The CSI 300 index fell 0.43 per cent to 4,066.67 after a wavy session.

The Shenzhen Composite index gained 0.41 per cent to 2,284.27. The ChiNext index slipped 0.29 per cent to 2,698.91.

2:08pm: Shenzhen Composite Index stands at 2,306.61, up 1.40 per cent or 31.77 points. ChiNext rallies 1.23 per cent, or 33.23 points, to 2,739.95.

2:07pm: Shanghai Composite Index gains 0.566 per cent, or 22.25 points, to 3,950.67. CSI300 Index edges up 0.261 per cent, or 10.65 points to 4,095.02.

2:05pm: Hang Seng Index adds 0.79 per cent, or 194.46 points, to 24,715.58. H-shares Index stands at 11,411.98, up 1.07 per cent, or 120.32 points.

1:57pm: As airlines extend their slide in Hong Kong – Air China, China Southern and China Eastern are down between 12 and 17 per cent today – oil-related stocks are lifting with an uptick in the global price.

China National Offshore Oil Corporation (CNOOC) is the fastest-rising Hang Seng Index stock, up 5.03 per cent to HK$10.02, while Sinopec Engineering is the top-gaining H-share, up 8.98 per cent to HK$6.92.

1:40pm: Heng Koon-how, FX strategist with Credit Suisse private banking:

“For now, this looks like a one off 2 per cent depreciation of the onshore yuan. The People’s Bank of China statement has made clear reference to the 'recent series of macroeconomic data,' implying that they acknowledge that the July activity indicators, from PMI to exports, have been weaker than expected.

The first part of the statement explains the motivation of the adjustment very clearly : making reference to US economic recovery, risk of upcoming Fed rate hike, strengthening US dollar, weakening euro and Japanese yen, weakening emerging market economies and weaker commodity related currencies, increasing financial market dynamics.

Needless to say, this move by PBoC has a rather negative impact on Asian currencies and Antipodeans as a whole. We have been negative on rest of Asians and Antipodeans and we stay negative.

We need to stress that there is urgent need to hedge Asian FX risk. This is not just a case of USD strength ahead of FED rate hike, but also weak domestic drivers. Today’s 2 per cent depreciation of the on-shore yuan adds to the urgency and volatile mix. Our point forecasts for weaker Asians looks likely to be reached sooner than later. Once again, we see the Malaysian ringgit, Korean Won and Indonesia rupiah as most vulnerable.”

1:32pm: JPMorgan comments on RMB devaluation:

“Today’s announcement caught the market (including us) by surprise. The possible reasons behind the policy actions are the strong onshore yuan appreciation in real effective exchange rate (REER) term has put a lot of pressure on China’s exports.

From June 2014 to July 2015, the onshore yuan has appreciated in REER term by 12 per cent, mainly because of US dollar appreciation. In the first seven months of the year, exports declined by 0.6 per cent compared to the same period of last year. Going forward, the currency appreciation will continue to drag on export growth. It is unlikely that China will achieve the 6 per cent trade growth target for this year.

It is a responsive action to the recent trend of weakening currency against US dollar in Asia region. In the past three months, Malaysia Ringgit depreciated against US dollar by 9.4 per cent, followed by Korean won (7.2 per cent), Thai baht (4.6 per cent), Singapore dollar (4.2 per cent), Taiwanese dollar (3.2per cent) and Indonesia rupiah (3.0 per cent).

We see two possible scenarios for the CNY outlook. In the first scenario, today’s move represents a regime-shift in China’s exchange rate system. Going forward, the People’s Bank of China will set the central parity rate based on the closing spot rate on the previous day. Technically, this means CNY will become a freely floating currency.

In the second scenario, the PBOC will try to re-anchor market expectations. That means the PBOC will sell US dollar in the spot market to prevent daily spots shifting away from the new central parity rate. Daily fixing will stay stable in the coming weeks. In this scenario, the intervention in the FX market will imply a further decline in FX reserve, affecting base money creation on the domestic front.”

1:06pm: Shenzhen Composite Index stands at 2,275.26, up 0.02 per cent or 0.41 points. ChiNext slips 0.98 or 26.44 points, to 2,680.28.

1:05pm: Shanghai Composite Index sheds 0.431 per cent, or 16.94 points to 3,911.48 at open of afternoon trade. CSI300 Index loses 0.575 per cent, or 23.47 points to 4,060.90.

1:05pm: Hang Seng Index rises 0.92 per cent, or 225.44 points, to 24,746.56 at the open of afternoon trade. H-shares Index stands at 11,451.59, up 1.42 per cent, or 159.93 points.

1:00pm: Eddie Cheung, Asia FX strategist of Standard Chartered Bank:

“We expect markets to remain jittery on concerns that this is a renewed push to weaken the on-shore yuan near-term. We believe this one-off devalution is a step further to forex reform but do not see it as a new trend devaluation.

This is another step in increasing the flexibility of China’s exchange rate, partly to increase the chances of renminbi inclusion in the IMF’s SDR basket by the end of this year. This also confirms our belief that despite concerns over growth and recent equity market volatility, the pace of reforms remains on track.

The next step is to widen the daily trading band. We maintain our call that a band widening from two per cent to three per cent is possible in the next few months.”

12:45pm: Paul Mackel, HSBC Head of Global Emerging Markets FX Research.

“In our view, there could be another important consideration behind today's announcement. We believe the People’s Bank of China is accelerating reforms to raise the chance of the RMB's inclusion in the IMF's SDR basket.

Although it is not explicitly mentioned, it is nevertheless understood that a reserve currency cannot be a highly managed one, which could potentially deviate from its underlying fundamental value thereby resulting in eventual instability. That was indeed the risk for USD-CNY, which has been held very steady, despite ongoing capital outflows from China.

Importantly, the change in the fixing mechanism should not be read as a sign that China’s authorities are purposely adopting an onshore yuan devaluation strategy.

In our view they have sufficient policy ammunition to boost domestic demand to offset external headwinds. We forecast another 25 basis points policy rate cut and 200 basis points reserve ratio cut in the second half of 2015. Today's change in the USD-CNY fixing mechanism will not impede RMB internationalisation efforts."

12:40pm: HSBC research quoting People’s Bank of China Q&A on the RMB devaluation:

1. The central bank addressed why it chose the current timing to reform the (yuna) fixing. The central bank highlighted a strong USD and the sharp appreciation in the RMB real effective exchange rate as a key macro consideration.

In such a context, the central bank noted the USDCNY fixing has shown significant deviation from market spot rate for a prolonged period of time, weakening the benchmarking function of the fix.

As domestic FX market becomes more developed, with market makers better equipped with risk management capability, the central bank believes it is time for a more market oriented fixing to better reflect market demand and supply.

2. The PBoC believed the sharp jump in today's USD-CNY mid-price is a one off correction of the fixing, in order for it to be closer to the previous days' prevailing spot rate. The central bank states that it will closely monitor market movements in the near future to make sure the new fixing mechanism runs smoothly and to stabilise market expectations.

3. The PBoC highlighted the next steps in China's exchange rate mechanism reforms. These include letting the market play a bigger role in deciding the exchange rate, retiring from the routine FX interventions, and allowing greater exchange rate flexibility as well as accelerating foreign exchange market development by broadening forex products, increasing exchange rate trading hours (details not yet announced), introducing qualified foreign investors and promoting a single exchange rate in the onshore and offshore markets.

12:25pm: The Hang Seng Index (orange) and H-shares index (purple) from opening to midsession today – click to enlarge.

12:22pm: The Hang Seng Index closed its morning trading at 24,752.87, up 0.95 per cent or 231.75 points. The China Enterprises Index (H-share index) adds 1.51 per cent, or 170.18 points, to 11,461.84.

11:53am: Onshore spot yuan is trading at 6.3154 against the US dollar, weaker by 1060 basis points from Monday close. The offshore yuan stands at 6.3598, weaker by 1462 basis points from Monday finish.

11:50am: China indices at midsession today: the Shanghai Composite (orange), Shenzhen Composite (green), CSI300 (purple) and ChiNext (blue). Click to enlarge.

11:39am: In Hong Kong, insurance stocks are leading banks as financials pick up to perform strongly today. Also running well are precious metals, with 8 per cent-plus gains for Sino Prosper and Lingbao Gold and 3 per cent-plus for G-Resources, Loco Hong Kong, Zijin Mining and Zhaojin Mining.

11:38am: The Shenzhen Composite Index goes down 0.25 per cent, or 5.8 points to 2,280.64 at the close of morning trade. The ChiNext Price Index slips 0.49 per cent, or 13.14 point,s at 2,693.58.

11:37am: The Shanghai Composite Index closed its morning session at 3,912.92 points, down 0.395 per cent, or 15.50 points. The CSI300 index of Shanghai-Shenzhen large cap stocks loses 0.475 per cent or 19.40 points to 4,064.97.

11:25am: Hong Kong dollar is trading Tuesday at 7.7543 to the US dollar, near upper end of the currency peg. Euro/dlr weaker by 0.32 per cent at 1.0984. Dlr/yen at 124.68, stronger by 0.04 per cent. Pound/dlr weaker by 0.17 per cent to 1.5566. Australian dollar to US dollar weaker by 1.17 per cent to 0.7326.

11:09am: Airline stocks divebomb today as a weaker RMB, slowing economy and the stock market crash are likely to hit demand for air travel.

China Southern Airlines (orange) plummets 13.33 per cent to HK$7.15, Air China (purple) drops 12.69 per cent to HK$7.43, and China Eastern Airlines (green) drops 8.73 per cent to HK$5.96. Hong Kong’s Cathay Pacific Airways (blue) is down 1.18 per cent to HK$18.46.

Click to enlarge this view against the Hang Seng (red) and H-shares (yellow) indices.

10:49am: The top 13 Hang Seng stocks in terms of percentage gains are China companies. China Resources Land is out in front, up 4.92 per cent to HK$22.40. Bank of East Asia is the top gainer among local blue chips. Property developers Cheung Kong, Henderson and MTR Corporation trail near the rear.

Hong Kong Exchanges and Clearing leads market turnover with HK$723 million, gaining 1.1 per cent to HK$220.60, followed by China majors Ping An Insurance, Tencent, ICBC and CCB, all up more than 1 per cent.

10:35am: The Shenzhen Composite Index advances 1.15 per cent, or 26.27 points to 2,301.11. The NASDAQ-style ChiNext Price Index lifts 0.75 per cent, or 20.25 points at 2,726.97.

10:34am: The Shanghai Composite Index stands at 3,945.06 points, up 0.424 per cent, or 16.64 points. The CSI300 index of Shanghai-Shenzhen large cap stocks rises 0.371 per cent or 15.15 points to 4,099.52.

10:33am: The Hang Seng Index stands at 24,829.94, up 1.26 per cent or 308.82 points. The China Enterprises Index (H-share index) gains1.99 per cent, or 225.13 points, to 11,516.79.

10:25am: Hong Kong stocks are surging after the RMB cut gave investors extra buying power. Cathay Pacific Airways is the only Hang Seng constituent trading down while Air China is the only H-shares index stock going backwards.

Several Chinese airlines are being pounded, continuing their rough few weeks in the news. Air China is down 6.11 per cent to HK$7.99, China Eastern drops 6.27 per cent to HK$6.12 and China Southern gives up 6.78 per cent to HK$7.69.

9:55am: China’s money supply M2 for July jumped 13.3 per cent from a year earlier, beating economist forecasts of a 11.7 per cent rise, while new yuan loans for the same period reached 1.48 trillion yuan versus a market consensus of 750 billion yuan, says a report Tuesday by the People’s Bank of China.

9:42am: The Shenzhen Composite Index opens at 2,290.39, up 0.68 per cent, or 15.54 points. The NASDAQ-style ChiNext Price Index adds 0.41 per cent, or 11.11 points to open at 2717.83.

9:41am: The Shanghai Composite Index opens the morning at 3,926.74 points, down 0.043 per cent, or 1.68 points on Monday’s close. The CSI300 index of Shanghai-Shenzhen large cap stocks opens at 4,083.44, down 0.023 per cent or 0.93 points.

9:40am: The Hang Seng Index opens at 24,795.92, up 1.12 per cent or 274.80 points. The China Enterprises Index (H-share index) opens at 11,481.59, up by 1.68 per cent or 189.93 points.

9:35am: AXA Investment Managers’ Mark Tinker:

“We appear to be seeing institutional investors give up on ’old China’ plays such as commodities and EM (debt and equity), as 1, 3 and 5 year numbers look shocking compared to equities. Within equities they are also cutting exposure to commodity and EM exposed stocks. It may be too early to be a contrarian as the selling could continue for some time yet, but valuation and fundamentals were favouring developed markets (DM) over EM stocks back in 2010. It looks a little late now, certainly for a long term investor.

If we look at correlation within markets, we notice that in Hong Kong at least correlations between stocks are close to an all-time high. This obviously reflects the unwind of the China trade for a number of investors and the fact that Hong Kong is providing the liquidity for them to do so.

Such an indicator is usually a signal for a short term reversal – and certainly the Hong Kong index appears to be close to the bottom here – which, should it persist, is not a healthy sign.

Another signal we are watching closely right now is the margin number in China since it is a necessary deleveraging trade that is underway in the mainland.

It is also worth noting that according to China Securities Depositary and Clearing, the number of retail investors in July fell to 51 million, from 75 million the previous month, suggesting a further reduction in momentum investors.

The big story remains the structural reform and evidence this week suggests it is still on track. The shadow banking system is a symptom of the fact that China does not yet have developed financial markets. Part of the response is to allow a shadow banking solution (for example Alibaba and money market funds) and then ‘co-opt it’ into the official system."

For their updated chart on Shanghai, please click below to enlarge.

9:23am: The People’s Bank of China sets the mid-price of onshore yuan trading at 6.2298, weaker by 1136 basis points to the US dollar from the last Monday mid-price fix.

9:20am: Societe Generale said in a report:

“The infamous pork cycle is heating up again: pork prices in the CPI basket have risen 17.4 per cent since May and were up 16.7 per cent yoy in July, which accounted for half of the headline CPI reading of 1.6 per cent yoy.

The current cycle is similar to the previous two disruptive cycles in terms of supply shortages, but lacks the equally critical support from the demand side.

Pork prices will probably keep rising and push CPI above 2 per cent yoy in the coming months, but the chance of CPI going much beyond 3 per cent is limited in our view.

Nevertheless, this inflation outlook is still likely to restrain the central bank's scope for policy rate cuts, but, if the economy keeps struggling, we will still see other forms of monetary policy easing.”

9:20am: Hong Kong listed companies issuing positive profit outlooks since last closing: China Water Industry Group, China Weaving Materials Holdings, China Chengtong Development Group, China Energine International, Dream International and Century Legend Holdings – the latter from a loss in the first half of last year.

Profits are expected to decline for Century Ginwa Retail Holdings and Poly Property Group. Neway Group, Active Group and Shuanghua Holdings forecast losses – the latter two from profits last year. Losses are expected to increase for China Finance Investment Holdings, China Qinfa Group and Kuangchi Science.

9:10am: Shanghai Composite Index little changed at 3,928.42 at pre-open session, while the CSI 300 Index was also indicated flat at 4,084.37.

9:10am: Chia Tai Enterprises (CT Enterprise) announced its interim results late Monday, showing a 7.4 per cent decline in revenue and 54.5 per cent drop in profits. Shares in the auto parts and industrial machinery group last traded at HK$4.95.

Wing Lee Property Investments also released interim results. Turnover was practically flat at just under HK$14 billion, but profit jumped from HK$23 million to HK$73 million as fair value of investment properties increased. Wing Lee will open at HK$1.36.

9:01am: The Hang Seng Index futures spot July contract rose 0.61 per cent or 149 points to 24,550 in the pre-opening session.

8:59am: Four Shanghai listed A-share companies applied to resume trading on Tuesday while three companies will suspend trading in their stock. The number of suspended companies in Shanghai is 90, representing 8.31 per cent of the total.

In Shenzhen, a total of 13 listed companies say they will resume trading on Tuesday, while two firms will suspend trading in their shares. Some 294 firms in Shenzhen are in voluntary suspension, accounting for about 17.38 per cent of total listed companies.

8:22am: The amount of bad loans in China’s commercial banks rose by 11 per cent in the second quarter of the year, according to data released Monday on China Bank Regulatory Commission website.

8:15am: Jiangsu-based China Yurun Food, the mainland’s second largest meat product supplier, reported late on Monday a net loss of 724.3 million yuan in the year’s first six months, compared to a net profit of 16.1 million in the year-earlier period, as it failed to pass on higher hog prices and production costs to customers. Gross profit margin sank to 2.7 per cent from 7.4 per cent in the year-earlier period.

8:05am: Prudential PLC (orange), an international life insurance and financial services group, is going to announce its interim result today. It share price has generally outperformed Hang Seng Index (purple) over the past three months, with short periods of correction between late May and early June. The company closed at HK$182.7 on Monday, down 0.814 per cent from last Friday’s close.

8:01am: Semiconductor Manufacturing International Corporation (orange), a Shanghai-based semiconductor foundry company, will announce its interim result today. The company closed at HK$0.72 on Monday, up 4.348 per cent from last Friday’s close.

Its share price outperformed Hang Seng Index (purple) in June, but subsequently took a dive in July due to the mainland stock market rout, and has underperformed the index in recent weeks. Click on chart below to enlarge.

7:58am: Beijing Capital Land, a property development and investment holding company, announced late Monday its net profit fell by 24 per cent year-on-year to 0.5 billion yuan. The company reported its contracted sales in the first half of 2015 reached 12.12 billion yuan, up by 79 per cent year-on-year.

Beijing Capital closed at HK$3.8 on Monday, down 0.262 per cent from the previous close.