SINGAPORE - Malaysian stocks and the ringgit were roiled on Monday (May 14), the first day of trading after a two-day market break imposed by Prime Minister Tun Mahathir Mohamad, who led the opposition coalition to a surprise election victory, raising concerns over campaign promises to drop a consumption tax and bring back fuel subsidies.

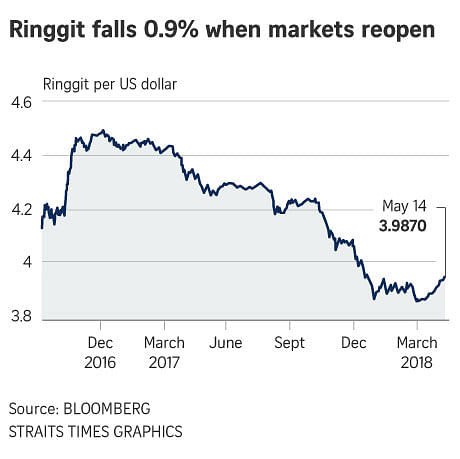

Malaysia's Kuala Lumpur Composite Index (KLCI) fell 1.7 per cent immediately after trading opened, while its currency dropped 0.9 per cent, the most since November 2016. Moody's Investors Service and Fitch Ratings have warned of risks to the budget if the goods and services tax (GST) is abolished and not offset by other revenue-raising measures.

Dr Mahathir's-led opposition coalition Pakatan Harapan (PH) had campaigned on a promise to scrap a consumption tax within its first 100 days in power, reintroduce petrol subsidies and review toll road concessions. In a press conference on Thursday, Mahathir emphasised his focus on expanding the economy and reducing debt. He also wants to review large-scale investment projects awarded during predecessor Najib Razak's term.

The ringgit slipped as much as 0.91 per cent against the Singapore dollar as at 9.30am on Monday, to touch 2.99 per Singdollar, and fell by 0.69 per cent against the US currency to nearly 3.98 a US dollar in early Monday trade, the highest since November 2016.

But at 11.19am, the KLCI had bounced back to erase its earlier losses, trading at 1,853.94 as at 11.15am, up 0.4 per cent or 7.43 points.

The Malaysian currency also recovered lost ground to trade at 2.9647 per Singdollar and at 3.9502 per US dollar as 12:25pm.

Dr Mahathir has looked to soothe markets by appointing Mr Lim Guan Eng as finance minister, adding that his administration will be friendly to business interests. He also appointed former central bank governor Zeti Akhtar Aziz to an economic advisory board.

Mr Lim's appointment was widely seen as "a safe choice and a key positive for markets," said Bank of Singapore's head of investment strategy Eli Lee.

However, not all market watchers were convinced by Dr Mahathir's moves.

"Some campaign promises, if implemented without adjustments or offsetting measures, would be credit negative for Malaysia," Moody's senior analyst Anushka Shah warned in a research note.

That includes the proposed abolition of the GST, which Dr Mahathir suggested would be replaced by reverting to a sales and service tax, similar to the tax in place before the GST.

Ms Shah said the sales and service tax was alone unlikely to match revenue collection from the GST, which in 2017 totalled RM44.3 billion (S$14.88 billion), or 3.3 per cent of GDP (gross domestic product). Removing the GST would also introduce risks of a narrowing revenue base and increased reliance on oil-related revenue, which has declined since the GST's introduction in 2014.

There was little clarity on PH's economic policy agenda, Ms Shah said, apart from a few specific campaign pledges that are credit negative at the outset, but lack details that would allow a full assessment of budgetary and macroeconomic effects.

"The Opposition's key plank was social and institutional change, focusing on a move away from corruption allegations that plagued the ruling party rather than specific economic reforms. The new government inherits an economy on a strong footing, with growth averaging 5.5 per cent over the past eight years, making Malaysia the fastest-growing A-rated sovereigns, globally," Ms Shah noted.

"Although the previous government achieved eight consecutive years of fiscal deficit reductions to 2.8 per cent budgeted for 2018, lower expenditures mainly drove the consolidation, with revenue falling as a share of GDP since 2012," she said, adding that Malaysia's high debt burden remains its key credit challenge.

She estimated Malaysia's debt to GDP ratio at 50.8 per cent at year-end 2017, significantly above the 40.1 per cent median for A-rated sovereigns.

"Given the government's limited ability to trim spending further, we expect the deficit and the debt burden to hover around current levels. However, a reversal of some past reforms without other adjustments risks widening the deficit," she wrote.

Bank of Singapore's Mr Lee said that looking ahead "significant uncertainties" remain. "Mahathir's coalition had campaigned on pledges to abolish the GST and implement fuel subsidies within the first 100 days, and it is yet unclear how these goals will be accomplished and what the net impact on fiscal consolidation and the country's credit rating will be," he said.

Stephen Innes, head of trading, APAC, at Oanda, said: "Let the chips fall where they may, and we could see traders on a cash market knee-jerk look to position long-term views based on Malaysia's solid domestic economic performance, high external factors and of course higher oil prices."

"The wild card in the deck remains the GST and how the debt agencies react to PM (Prime Minister) Mahathir's pledge to scrap the unpopular tax within 100 days," he added.