With Japanese markets closed for Constitution Day, the yen is having a quiet day. In the North American session, USD/JPY is trading at 109.91, up 0.05% on the day. On the release front, Japanese Consumer Confidence fell to 43.6 points, missing the estimate of 44.6 points. In the US, ADP Nonfarm Payrolls dropped to 204 thousand, compared to 241 thousand a month earlier. Still, this beat the estimate of 200 thousand. Later in the day, the Federal Reserve will set the benchmark interest rate and issue a rate statement. On Thursday, the US releases two key indicators – unemployment claims and ISM Non-Manufacturing PMI.

What can we expect from the Federal Reserve? At the March policy meeting, policymakers raised rates for the first time in 2018, and are expected to remain on the sidelines at today’s meeting. Analysts will be keeping a close eye on the rate statement for clues about future rate hikes. Although the Fed is currently projecting three rate hikes in 2018, there is growing sentiment that the Fed will bump this up to four increases. The CME Group (NASDAQ:CME) has priced in a quarter-point hike in June at 93% and one scenario is that the Fed will keep raising rates once each quarter – in June, September and December. Higher inflation has raised speculation that the Fed will consider raising its rate hike forecast. The Fed’s preferred inflation gauge, the Personal Consumption Expenditures price index, hit the Fed’s target of 2% inflation for the first time in a year in March.

Like many other industrialized countries, Japan’s economy experienced a slowdown in the first quarter of 2018. Annualized growth in Q4 stood at 1.6% but stands to drop sharply in Q1, with an estimate of just 0.5%. One factor in the slowdown is a significant drop in exports, due to the stronger Japanese currency. The yen has gained about 3% against the dollar in 2018, hurting the competitiveness of Japanese exports. Still, the economic recovery has been impressive, as the economy has expanded for eight consecutive quarters, its longest streak since the 1980s. The Japanese consumer, however, remains pessimistic, and the April reading of 43.6 marked an 8-month low.

USD/JPY Fundamentals

Wednesday (May 2)

- 1:00 Japanese Consumer Confidence. Estimate 44.6. Actual 43.6

- 8:15 US ADP Nonfarm Employment Change. Estimate 200K. Actual 204K

- 14:00 US FOMC Statement

- 14:00 US Federal Funds Rate. Estimate

Thursday (May 3)

- 8:30 US Unemployment Claims. Estimate 225K

- 10:00 US ISM Non-Manufacturing PMI. Estimate 58.1

*All release times are DST

*Key events are in bold

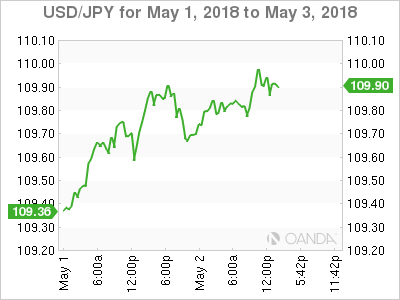

USD/JPY for Wednesday, May 2, 2018

USD/JPY May 2 at 8:50 DST

Open: 109.86 High: 109.93 Low: 109.65 Close: 109.91

USD/JPY Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 107.29 | 108.00 | 108.89 | 110.11 | 111.22 | 112.06 |

USD/JPY ticked lower in the Asian session and is showing little movement in European trade. The pair has edged higher in the North American session

- 108.89 is providing support

- 110.11 is the next resistance line

Further levels in both directions:

- Below: 108.89, 108.00, 107.29 and 106.64

- Above: 110.11, 111.22 and 112.06

- Current range: 108.89 to 110.11

OANDA’s Open Positions Ratios

USD/JPY ratio is showing little movement in the Wednesday session. Currently, long positions have a majority (62%), indicative of trader bias towards USD/JPY reversing directions and heading lower.