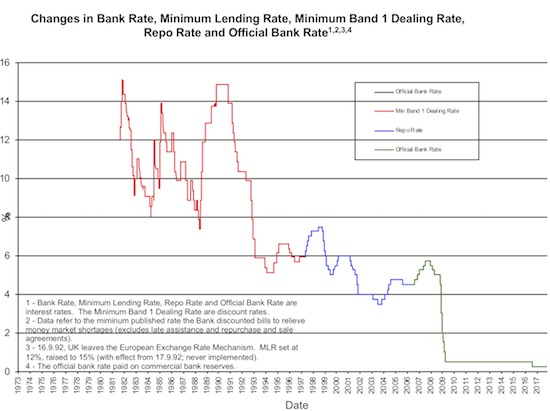

The following chart reminds me that except for one post-Brexit emergency rate cut and its rapid reversal once the cut turned out to be unnecessary, the Bank of England (BoE) has done nothing with interest rates in the 9 years since the financial crisis.

The last 9 years of essentially flat rates is the longest time of inactivity for the Bank of England since at least 1980.

During an interview with the BBC on April 19th, BoE Governor Mark Carney made a not-so-subtle attempt to throttle the latest run-up in the British pound (NYSE:FXB) by throwing more uncertainty into the timing of the next (alleged) rate hike. It was a performance befitting the last 9 years of talking about rate moves and yet doing almost nothing. While claiming that “a few” rate hikes would occur “over the next few years,” Carney noted the recent softness in UK economic data and the ongoing dampening effect of Brexit negotiations.

It was the classic technique of Carney during his tenure at the BoE of promising to do something off in the future while making sure nothing happens in the short-term. He did not read like a central banker who would go into a meeting on monetary policy brimming with economic confidence. To see what real confidence looks like refer to the Senior Deputy Governor of the Bank of Canada (BoC) Carolyn A. Wilkins who expertly signaled the first of two rate hikes last year for the BoC.

The BBC interviewer concluded “Listening to the governor, I sensed that he was a little more doveish on the possibility of an interest rate rise next month than he had been previously.” You think?

An April 27th Reuters piece titled “Mark Carney can delay UK rate rise with impunity” echoes some of my sentiments:

“Mark Carney can now procrastinate with impunity. A sharp slowdown in UK growth in the first quarter, announced on Friday, gives the Bank of England governor a good reason to delay raising UK interest rates. A slackening in economic activity in continental Europe makes it practically reckless for him to do anything else at a May 10 policy meeting.”

Bloomberg showed how Carney’s interview plunged the odds of a rate hike at the May 10th meeting from 77% to 54%. As of the 27th, the odds fell all the way to around 33%.

The British pound has sold off in kind, and it has yet to stop falling. This drop no doubt gives the BoE some cushion ahead of any rate hike it actually executes this year. At a minimum Carney’s throttling should neatly suppress the market’s desire to try to get far ahead of anticipated and elusive rate hikes.

Carney helped knock GBP/USD off its perch. If the late February low gives way, then the uptrending 200DMA goes into play.

With some of a lot of air let out of the pound, I have gone long GBP/USD. The pair serves as a nice hedge for my general bullishness on the U.S. dollar. If the BoE fails to hike rates, the pound should not fall much further. If it hikes rates, the pound should edge higher. In either case, the BoE is likely to caveat and condition its language enough so it appears neither too hawkish in the case of a rate cut or too dovish in the case of doing nothing.

Be careful out there!

Full disclosure: long GBP/USD