Talking Points:

- US Dollar outlook firmly anchored to Senate tax proposal

- British Pound and NZ Dollar retrace in Asia Pacific trade

- Anti-risk Yen pressured as Japanese shares power higher

Another quiet day on the economic data front is likely to keep US tax cut prospects front and center. The Senate is due to release its version of a plan today, with substantive differences from last week’s House of Representatives proposal all but certain. Traders will eagerly comb through the details, with the subsequent reaction reflecting the probability of passing reconciled legislation in the relatively near term.

The markets have speculated since last year’s election that expansionary fiscal policy favored by President Trump will boost growth, lifting shares and other cycle-sensitive assets. It was also seen as likely to stoke inflation and force the Fed into a steeper rate hike cycle. That provides a framework to analyze how markets might on-board whatever crosses the wires in the coming hours.

A Senate tax plan that doesn’t veer too far from the House version – making for a relatively easier reconciliation process – and offers immediate corporate tax relief (as opposed to deferring it, as has been suggested) may boost the US Dollar. A significant departure from the House proposal that casts doubt on the viability of legislative success is likely to have the opposite effect, especially if the cuts are delayed.

The British Pound corrected broadly higher in Asia Pacific trade, retracing after yesterday’s politically-inspired selloff. The New Zealand Dollar edged down having soared after an unexpectedly upbeat RBNZ monetary policy announcement. The Yen also declined as Japanese stocks pushed higher, sapping demand for the standby anti-risk currency.

What is the #1 mistake that traders, and how can you fix it? Find out here !

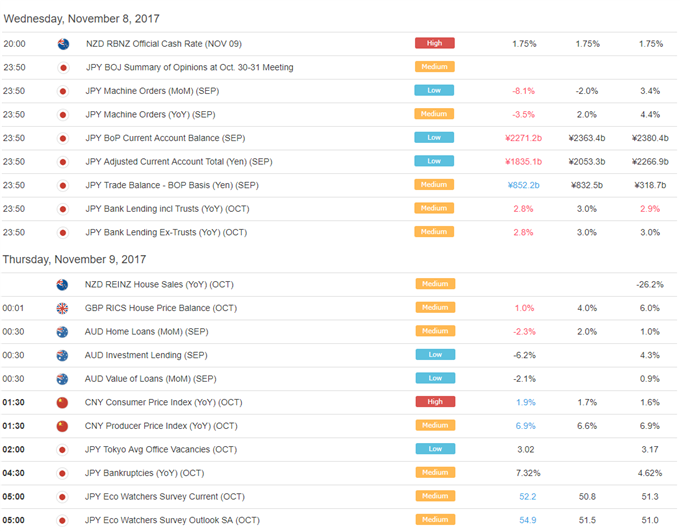

Asia Session

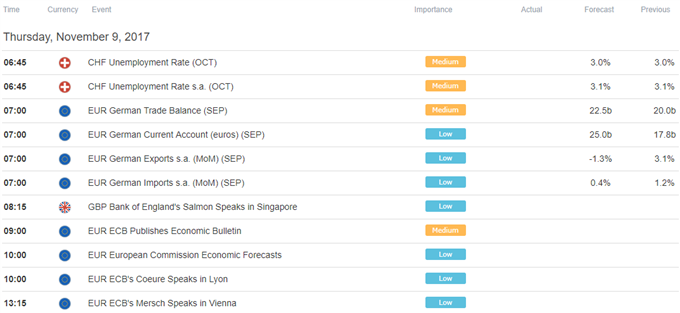

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak