USD/JPY is showing little movement in the Monday session. In North American trade, the pair is trading at 110.50, down 0.22% on the day. In Japan, Preliminary Industrial Production gained 1.6%, matching the forecast. As well, Housing Starts posted a strong gain of 1.7%, crushing the estimate of 0.1%. Later in the day, Japan releases Final Manufacturing PMI. Over in the US, we’ll get a look at Pending Home Sales, which is expected to gain 0.9%. On Tuesday, the US releases two key indicators – Personal Spending and ISM Manufacturing PMI.

Japanese manufacturing and industrial indicators for June started the week on a positive note. Preliminary Industrial Production rebounded with a strong gain of 1.6%, after a decline of 3.3% in the May. As well, Housing Starts gained 1.7%, compared to a reading of -0.3% in May. These numbers underscore a stronger Japanese economy, buoyed by stronger demand for Japanese exports. Still, weak inflation levels remain a serious concern. The BoJ’s ultra-loose monetary policy has failed to coax inflation upwards, and consumers remain wary, as borrowing and spending levels remains soft. At its policy meeting earlier in July, the BoJ again extended its time-frame for reaching its inflation target of 2%. The bank is reluctant to make scale back its asset-purchase program, which means that it will likely lag behind other central banks, such as the ECB, in reducing its stimulus program.

The US dollar has posted broad losses in response to climbing political risk in the US. This was again the case on Friday, as President Trump’s struggling healthcare bill gasped its final breath as the bill was defeated in the Senate after three Republican lawmakers joined the Democrats and voted against the bill. This is another setback for President Trump, who has been unable to get Congress to pass any significant legislation, despite the Republicans controlling both the House and the Senate. Trump will now be able to focus on other issues such as tax reform, but investors are skeptical as to whether the President will have the support he needs in Congress to pass major legislation. On Monday, USD/JPY touched a low of 110.30, its lowest level since June 15.

USD/JPY Fundamentals

Sunday (July 30)

- 19:50 Japanese Preliminary Industrial Production. Estimate 1.6%. Actual 1.6%

Monday (July 31)

- 1:00 Japanese Housing Starts. Estimate 0.1%. Actual 1.7%

- 9:45 US Chicago PMI. Estimate 60.8

- 10:00 US Pending Home Sales. Estimate 0.9%

- 20:30 Japanese Final Manufacturing PMI. Estimate 52.2

- 23:45 Japanese 10-y Bond Auction

Tuesday (August 1)

- 8:30 US Personal Spending. Estimate 0.1%

- 10:00 US ISM Manufacturing PMI. Estimate 56.4

*All release times are GMT

*Key events are in bold

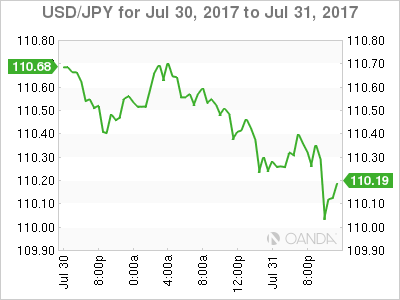

USD/JPY for Monday, July 31, 2017

USD/JPY July 31 at 10:45 EDT

Open: 110.68 High: 110.77 Low: 110.31 Close: 110.44

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 107.49 | 108.69 | 110.10 | 110.94 | 112.57 | 113.55 |

USD/JPY has showed limited movement in the Monday session

- 110.10 is providing support

- 110.94 is the next resistance line

Current range: 110.10 to 110.94

Further levels in both directions:

- Below: 110.10, 108.63 and 107.49

- Above: 110.94, 112.57, 113.55 and 114.37

OANDA’s Open Positions Ratios

In the Monday ratio, USD/JPY ratio is showing long positions with a majority (57%). This is indicative of trader bias towards USD/JPY continuing to move downwards.