Money

38 Incredible Facts on the Modern U.S. Dollar

38 Incredible Facts on the Modern U.S. Dollar

The Money Project is an ongoing collaboration between Visual Capitalist and Texas Precious Metals that seeks to use intuitive visualizations to explore the origins, nature, and use of money.

We’ve previously showed you 31 Fascinating Facts About the Dollar’s Early History, which highlighted the history of U.S. currency before the 20th century. This was a very interesting period in which we looked at the money used by the first colonists, the extreme bust of the Continental currency, the era of privately-issued bank notes, and Congress’ emergency issuance of the fiat “greenback” during the Civil War.

However, the modern era of the U.S. dollar is just as interesting. We have it starting in 1913, when the Federal Reserve Act was passed by Woodrow Wilson. Not only did it establish a new central bank, but it also gave the Fed the authority to issue the Federal Reserve Note, which is now the dominant form of U.S. currency both domestically and abroad.

A New Legal Tender

Leading up to the 20th century, there were four main forms of U.S. currency being used:

- Gold and silver coins

- Gold and silver certificates

- Commercial bank notes, issued by private banks and backed by government bonds

- “Greenbacks”, a fiat currency declared legal by Congress to help fund the Civil War

In 1913, however, the Federal Reserve Note was authorized as U.S. currency. The new notes were supposed to be backed by gold or other “lawful money”, based on the stipulations of the Federal Reserve Act of 1913.

However, this only lasted about 20 years. By the time of the Great Depression, the Fed considered itself to be in a tight spot. It simply did not have enough gold to back all Federal Reserve Notes and Gold Certificates in circulation, and at the same time wanted flexibility with monetary policy to fight deflation and unemployment.

In 1933, the Emergency Banking Act was passed by President Roosevelt, and Executive Order 6102 was also signed. The latter move famously criminalized monetary gold, and ended the gold standard.

After all, if gold can’t be legally owned, it can’t be legally redeemed.

Modern Paper Money

After a brief return to a pseudo gold standard after WWII, Nixon severed all remaining ties between gold and money in 1971. Since then, U.S. money has been purely fiat, and backed by the government rather than any physical commodity or precious metal.

Some facts on today’s paper money:

- There is $1.54 trillion of U.S. currency in circulation, and 97% of that is Federal Reserve Notes

- Over two-thirds of all $100 bills are held outside the U.S.

- Dollar bills can be folded at least 8,000 times, which is 20x more than a normal sheet of paper

- That’s because dollar bills are made of a special 75% cotton and 25% linen blend, patented by Crane & Co.

- The U.S. Bureau of Engraving and Printing produces 38 million notes every day, worth $541 million

- The two facilities, located in Washington, D.C. and Fort Worth, Texas use 9.7 tons of ink per day

- For 2017, the Fed ordered 7.1 billion new notes, worth $209 billion

- More than 70% of these notes are used to replace damaged ones

- Notes with smaller denominations ($1, $5, $10) tend to last for shorter periods of time, due to more frequent usage

Coins

The coins used today are similar to U.S. Federal Reserve Notes in that their face values tend to greatly exceed their intrinsic values.

This is because cheaper metals such as copper, zinc, and nickel are used instead of gold or silver.

- The average lifespan of a coin is 25 years, according to the U.S. Mint

- It’s estimated that Americans throw away around $62 million of coins every year

- In 2016, the U.S. Mint produced 16 trillion coins, valued at over $1.09 billion

- The amount of copper in a penny has fluctuated over the years. It ranges from 0% (in WWII, pennies were made of steel so copper could be used for ammunition) to 95%.

- Today’s pennies are 2.5% copper, with the remainder being 97.5% zinc

Markets

Top 10 Countries Most in Debt to the IMF

Argentina tops the ranking, with a debt equivalent to 5.3% of the country’s GDP.

Top 10 Countries Most in Debt to the IMF

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Established in 1944, the International Monetary Fund (IMF) supports countries’ economic growth by providing financial aid and guidance on policies to enhance stability, productivity, and job opportunities.

Countries seek loans from the IMF to address economic crises, stabilize their currencies, implement structural reforms, and alleviate balance of payments difficulties.

In this graphic, we visualize the 10 countries most indebted to the fund.

Methodology

We compiled this ranking using the International Monetary Fund’s data on Total IMF Credit Outstanding. We selected the latest debt data for each country, accurate as of April 29, 2024.

Argentina Tops the Rank

Argentina’s debt to the IMF is equivalent to 5.3% of the country’s GDP. In total, the country owns more than $32 billion.

| Country | IMF Credit Outstanding ($B) | GDP ($B, 2024) | IMF Debt as % of GDP |

|---|---|---|---|

| 🇦🇷 Argentina | 32 | 604.3 | 5.3 |

| 🇪🇬 Egypt | 11 | 347.6 | 3.1 |

| 🇺🇦 Ukraine | 9 | 188.9 | 4.7 |

| 🇵🇰 Pakistan | 7 | 374.7 | 1.8 |

| 🇪🇨 Ecuador | 6 | 121.6 | 4.9 |

| 🇨🇴 Colombia | 3 | 386.1 | 0.8 |

| 🇦🇴 Angola | 3 | 92.1 | 3.2 |

| 🇰🇪 Kenya | 3 | 104.0 | 2.8 |

| 🇬🇭 Ghana | 2 | 75.2 | 2.6 |

| 🇨🇮 Ivory Coast | 2 | 86.9 | 2.3 |

A G20 member and major grain exporter, the country’s history of debt trouble dates back to the late 1890s when it defaulted after contracting debts to modernize the capital, Buenos Aires. It has already been bailed out over 20 times in the last six decades by the IMF.

Five of the 10 most indebted countries are in Africa, while three are in South America.

The only European country on our list, Ukraine has relied on international support amidst the conflict with Russia. It is estimated that Russia’s full-scale invasion of the country caused the loss of a third of the country’s economy. The country owes $9 billion to the IMF.

In total, almost 100 countries owe money to the IMF, and the grand total of all of these debts is $111 billion. The above countries (top 10) account for about 69% of these debts.

-

Maps7 days ago

Maps7 days agoMapped: Southeast Asia’s GDP Per Capita, by Country

-

Markets2 weeks ago

Markets2 weeks agoVisualizing Global Inflation Forecasts (2024-2026)

-

United States2 weeks ago

United States2 weeks agoCharted: What Southeast Asia Thinks About China & the U.S.

-

United States2 weeks ago

United States2 weeks agoThe Evolution of U.S. Beer Logos

-

Healthcare1 week ago

Healthcare1 week agoWhat Causes Preventable Child Deaths?

-

Energy1 week ago

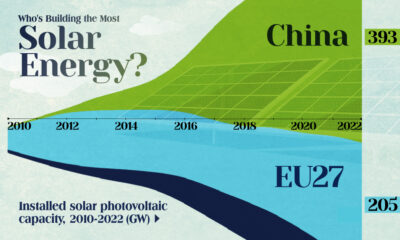

Energy1 week agoWho’s Building the Most Solar Energy?

-

Markets1 week ago

Markets1 week agoMapped: The Most Valuable Company in Each Southeast Asian Country

-

Technology1 week ago

Technology1 week agoMapped: The Number of AI Startups By Country