HKD at 6-week high to the pound in wake of shock UK election result

US dollar cleans up as UK election stuns sterling, but impact seen smaller than last year’s Brexit vote

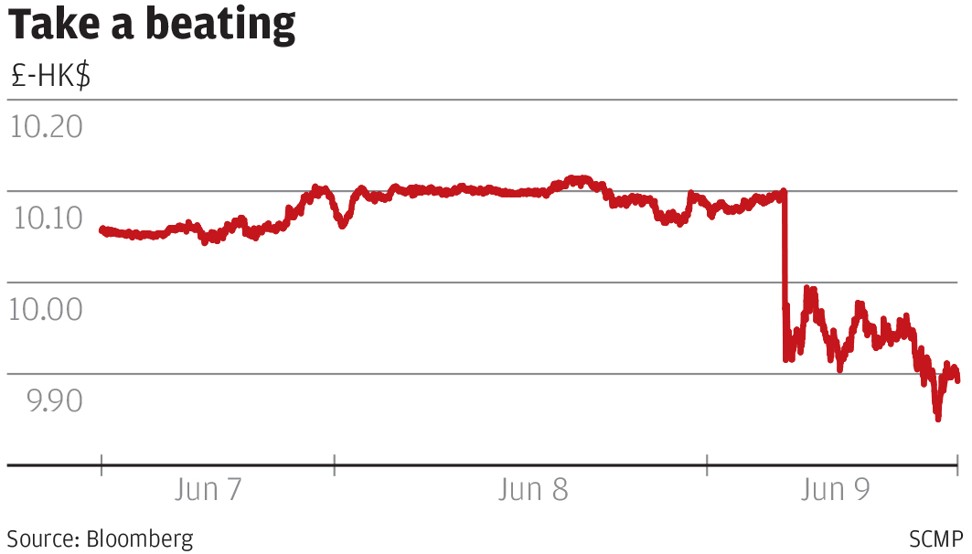

The Hong Kong dollar strengthened against sterling on Friday as the British elections left no single party with a clear claim to power, sideswiping investors who had already weathered major risk events in the United States and Europe.

While Hong Kong people may continue to take advantage of the weak pound for their travel, studies or even property purchases in the country, the impact from the election was viewed as far less than last year’s Brexit vote.

Hong Kong’s dollar climbed to its strongest level since April 25 against sterling while firming up slightly against the greenback. Other Asian currencies such as China’s yuan and Malaysia’s ringgit also gained.

The pound’s loss of 2 per cent against the dollar in the Asian session, as much as 2.4 per cent in early European trade, reflected fears the political turmoil could delay and confound talks on leaving the European Union, which are due to start in less than two weeks.

Yields on 10-year gilts (UK government bonds) also fell 3 basis points to 1.00 per cent, although FTSE futures recouped early losses and turned 0.2 per cent higher, perhaps on hopes that a weaker pound would help the economy.

The drop in sterling may not do much to school fees as the drop was not as drastic as a year ago during Brexit, which in some cases students saw students saving more than HK$40,000 in university tuition fees

Last year’s Brexit vote caused the pound to plunge by as much as 10 per cent in a single day and triggered a wave of outflows into Asia and into their currencies, including Hong Kong’s.

In comparison, the impact from the UK election was smaller, given that Asian currencies have already strengthened significantly since last year.

“The drop in sterling may not do much to school fees as the drop was not as drastic as a year ago during Brexit, which in some cases students saw students saving more than HK$40,000 in university tuition fees,” said Samuel Chan Sze-ming, managing director of an education consultancy firm, Britannia StudyLink.

Chan said many independent schools in the UK have been scouting for more Hong Kong students to make up for the fall off in numbers of European students after the uncertainties brought about by Brexit last June.

“Some secondary schools have even offered not to increase school fee if overseas students are willing enrol for a number of years,” he said, adding that there are currently 13,000 Hong Kong students studying at undergraduate level in the UK.

The damage was also limited elsewhere, with E-mini futures for the S&P 500 edging up 0.1 per cent.

Japan’s Nikkei added 0.5 per cent and MSCI’s broadest index of Asia-Pacific shares outside Japan were all but flat.

According to international property consultant JLL’s research, 82 UK property exhibitions were held in Hong Kong between July 2016 and March 2017, with apartment prices averaging HK$4 million (US$514,049), 19 per cent more than the previous year.

Visit Britain, the UK tourism board, recorded 1 million Hong Kong visitors to the country last year, the highest number since 2002, and 2.7 per cent of the total visitors.

Additional reporting from Kinling Lo