Credit Suisse has just reported first quarter earnings which show Switzerland's second-largest bank beating expectations, helped by a strong performance across the board. The bank simultaneously announced its intention to pursue a 4 billion swiss franc ($4 billion) capital raise.

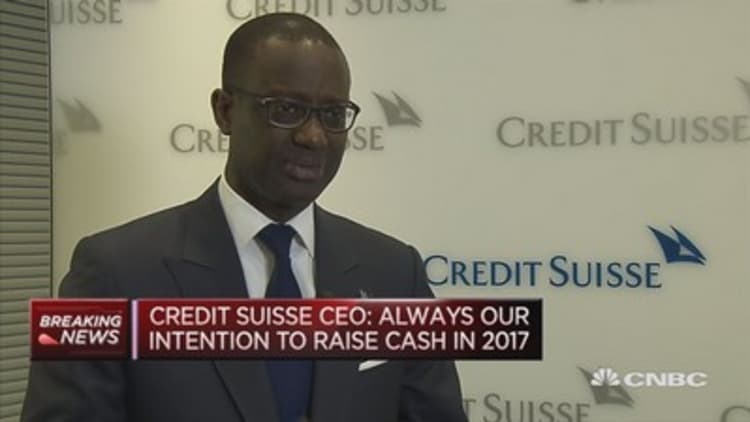

It's been "a good quarter, the best quarter in a while," Chief Executive Officer (CEO) Tidjane Thiam told CNBC on Wednesday from the group's Swiss headquarters.

"The very deep, hard restructuring that we talked so much about in 2016 is finally producing some results with 10 percent return on capital which was our 2018 target for global markets which many people thought unachievable," he stated.

On Wednesday the bank announced it would seek to pursue

Thiam noted that the significant improvement in operations in combination with improved financial certainty due to settling with the U.S. Department of Justice last January over allegations of its

"We always knew that the IPO has downsides - that it is quite dilutive - and that it wasn't ideal. But at the time it was a good way to deal with the CHF 2 – 4 billion gap which we couldn't fill because we couldn't at that time have done a CHF 10-11 billion rights issue," said the CEO from the company's Swiss headquarters.

Thiam emphasized the consistency in Credit Suisse's plans, noting that the bank had declared an intention to raise CHF 9 – 11 billion of capital two years' ago and that now having raised CHF 6 billion already and having generated a further CHF 1 billion through internal measures, the options on the table to secure the remaining funding were an IPO and a capital raise.

While the measure would be unlikely to eliminate all chatter over the strength of the bank's funding position, "it removes uncertainty for the foreseeable future and for all reasonable scenarios," declared Thiam.

Looking to this quarter, the CEO said that nerves over political uncertainty due primarily to the French election

"In terms of wealth management, net new assets (NNA) has remained strong in April, so we've seen those trends continue. For the rest of the market we will be quite cautious because April was very much impacted as we saw on Monday," Thiam explained, highlighting the buoyant trader reaction to independent centrist Emmanuel Macron, securing the highest level of votes in the first round of the election.

"All markets were impacted in terms of

Looking further ahead, the CEO noted that client confidence has been strongly boosted by Sunday's result.

"What we see is really much more confidence in clients. The outcome that was feared at some point – a Melenchon-Le Pen second-round…the relief from not having seen that has really helped sentiment a lot."

Credit Suisse's leadership team is gearing up for its annual shareholder meeting later this week with a proposal for the bank's bosses to have their bonuses slashed by 40 percent on the table.

Thiam said the measure was being taken to ensure management could be left alone to focus on their jobs and that the proposal was being pursued, "willingly, without pressure from anybody because we hope that it will allow people to move on."

Investors had been awaiting further news on Credit Suisse's funding plans with concerns in the wake of Deutsche Bank's 8 billion euro capital raise in February that the bank would announce a similar large-scale raise weighing on its share price in recent weeks.

Credit Suisse also unveiled a proposal to switch to an all-cash dividend in the future.

The bank's shares opened around a third of a percent lower before trading up around 1.37 percent by 09:10 a.m. local time.