Stock market today: S&P 500 clinches record close as Intel rally lifts chip stocks

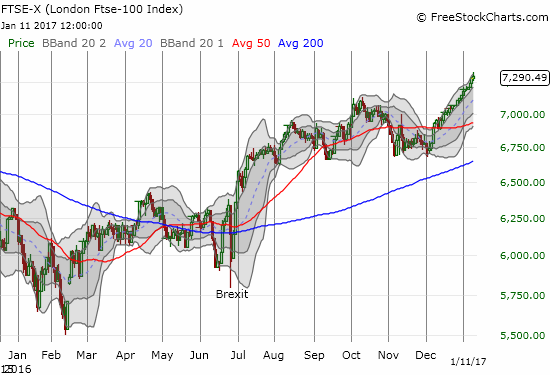

The UK’s FTSE 100 remains a big post-Brexit winner. This headline from the Telegraph for January 10, 2017 says it all: “FTSE 100 records longest run of closing highs since 1984 as Brexit fears hurt pound.”

Straight up for the FTSE 100 for over a month…

The FTSE 100 was created in 1984. Never since that time, the index has notched nine straight all-time highs as it has done now. The eleven straight days of gains are also an all-time record for the index. This run matches similar runs in 1997, 2004 and 2009.

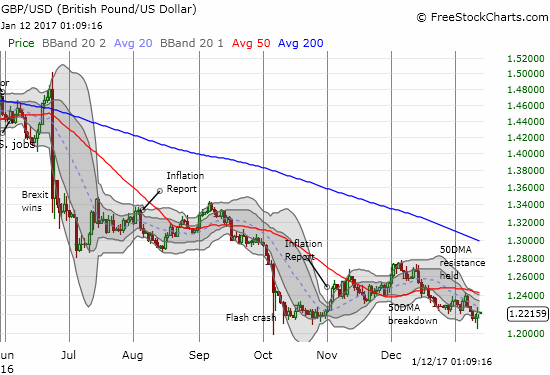

These gains are coming partially at the expense of the British pound (Guggenheim CurrencyShares British Pound Sterling (NYSE:FXB)). The pound last peaked in early December against the U.S. dollar and the euro. Against the yen, the pound last peaked in mid-December. For each currency pair, important technical milestones have occurred.

GBP/USD is challenging multi-decade lows again. A 50DMA breakdown on December 15th was confirmed by failure at resistance last week.

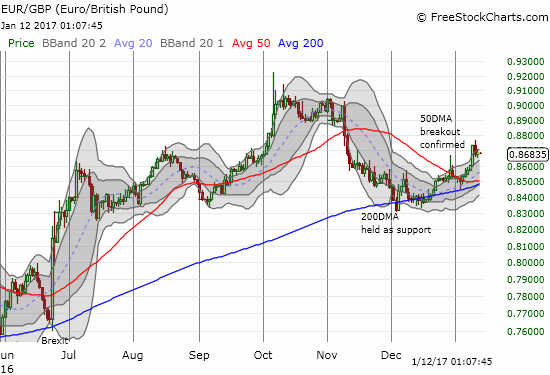

EUR/GBP gave its 200DMA a serious and successful test in December. The month ended with a major 50DMA breakout that was confirmed last week with a renewed surge off its 50DMA as support.

This week started with a major 50DMA breakdown for GBP/JPY. The move was just as dramatic as the parallel 200DMA major breakout at the end of November.

GBP/AUD never broke through its 200DMA downtrend which was confirmed as resistance after Brexit. If history is any guide, the major 50DMA breakdown from last week is just the beginning of a new, long slide.

Taken together, these technical developments have confirmed my nascent fear from early December that buying interest in the British pound was starting to dry up. The reversal in outlook forced me to switch the bias of my trading on the British pound from hedged bullish to mainly bearish. I am particularly interested in fading a (relief) rally on GBP/AUD despite my growing bearishness on the Australian dollar.

The irony of the renewed weakness in the pound is that 2016 ended with a combination of news that could have supported the British pound.

Inflation hit a 2-year high in November. Analysts claim that currency hedging has so far buffered follow-through price hikes to British consumers, but this juggling will come to an end in the second quarter of 2017. Not only do these price dynamics validate the Bank of England’s suggestion that it is done with rate cuts in response to Brexit, but also I think these dynamics slightly increase the odds of a reversal in policy.

A drop in foreign investment looms as one of the biggest post-Brexit fears for the UK economy. On December 30th, Liam Fox, the UK’s (post-Brexit) International Trade Secretary, claimed that his department landed more than £16.3 billion of foreign direct investment with billions more to come. Add this news on top of the good economic news hat forced the Bank of England to stand down from its initial plan to cut rates one more time before the end of 2016.

Going forward, I am looking to a fresh intensification of Brexit concerns as the time approaches for the UK to officially begin the exit process (the infamous Article 50). Under such circumstances, it is hard to imagine the British pound gaining any lasting positive tailwinds.

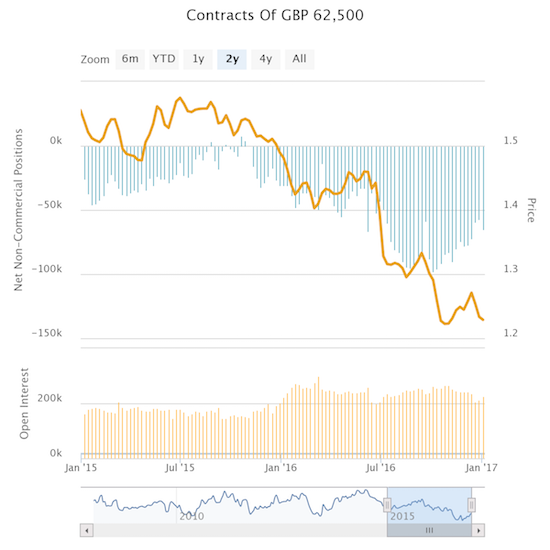

Speculators INCREASED net shorts against the British pound for the first time since late November. Are they now ready to stand their ground?

Full disclosure: net short the British pound

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes dozens of winning stock portfolios chosen by our advanced AI.

Year to date, 3 out of 4 global portfolios are beating their benchmark indexes, with 98% in the green. Our flagship Tech Titans strategy doubled the S&P 500 within 18 months, including notable winners like Super Micro Computer (+185%) and AppLovin (+157%).

Which stock will be the next to soar?